You probably want to make money by purchasing a website, growing it, and then enjoying monthly profits or flipping it for a higher price. Awesome! In this guide, you will learn how to buy a website that will be a winner.

We’ve written this guide for first-time website buyers interested in five- and six-figure transactions: small blogs, eCommerce stores, SaaS companies, and affiliate marketing blogs.

By reading it from top to bottom, you will find out why you should buy a website, what kind of business you should look into, where you can find them, how to distinguish real opportunities from scams, and how to determine the fair market value of a website before you make an offer.

Besides that, we will talk about how to complete a website acquisition and your next steps to start monetizing correctly and making money.

There is plenty to do, so let’s start. You can read the guide from the beginning to the top or select the section that interests you from the table below.

Table of Contents

- 1 Five Reasons to buy a website

- 2 What kind of online businesses can you buy

- 3 Where can I purchase websites?

- 4 What financing options do you have?

- 5 Make an offer and do price negotiations

- 6 Complete the purchase

- 7 What are the next steps after buying a website?

- 8 Buying an online business FAQ

- 9 Tips from people who purchased websites

- 10 Conclusion

Five Reasons to buy a website

There are many reasons to acquire a website. Some people do it to earn a semi-passive income (I’m afraid I have to disagree with those who say that a website is a passive income stream. If you don’t take care of it and grow, it will eventually stop making money); and others because they want to improve their digital presence.

The most experienced ones buy to skip the first year or two of the cashless hustle common for online entrepreneurs.

The list of reasons could go on…

You may think you should start a website from scratch instead of buying one. I recommend you not to do it:

Here are, in my opinion, the top 5 reasons why you should buy a website:

1. Skip the first year or two of cashless hustle 👌

That’s because you must perform many tests and tweaks to determine what works and what doesn’t. You don’t know if your product or service is what the market wants or if it will ultimately be profitable.

On the other hand, when you purchase a website already established, trust and authority in the niche come with confidence and control. It also comes with a product or service already tweaked and, most importantly, generating profits.

Of course, you may purchase a nonprofitable website. Still, if you choose this path, you should ensure that you have the knowledge, resources, and willingness to invest in reversing the trend and transforming it into a money-making machine.

2. Gives freedom 👌

3. Offers incredible scalability 👌

Once successful marketing and advertising strategies are identified, an online business can open up its target and increase the budget to grow quickly.

4. Gives access to a worldwide market 👌

An online business can thrive with a well-thought-out social media plan, search engine optimization, and paid media strategies. You have access to the entire world right at your fingertips.

5. You are building an income-producing asset 👌

Building and growing a website in turbulent economic times has excellent benefits. Instead of seeing your hard-earned money eaten slowly (or not) by inflation, you should consider investing in a website that generates revenue monthly and increases its value.

What kind of online businesses can you buy

Nowadays, there are many kinds of websites, including blogs, niche authority websites, affiliate websites, Shopify stores, SaaS, courses, and consultancy.

Next, we will talk in detail about five of them that I consider better to be purchased by first-time buyers.

Buying blogs

Blogs are significant assets because they have an active audience that sticks with the website. So, buying a blog may be the safest way to increase your profits.

A warning: Stay away from blogs tied to a personal brand. When the previous owner leaves, the audience may leave the blog if the new owner can not engage them with the project.

When you consider buying a blog, there are two significant questions to consider:

- How is the blog monetized?

- How do readers discover it?

How is a blog monetized?

There are several common ways to monetize a blog. You can use display ads, affiliate marketing, sell digital or physical products, or offer professional services.

Once you know how the blog is monetized, you can look for low-hanging fruit in the form of under-monetized aspects of the business. Maybe the former owner only used ads and never took the time to add affiliate marketing or create and sell their digital products. That could be an opportunity to increase the monthly recurring revenue.

Or maybe the current ads are under-monetized. Every ad platform compensates people differently. It may be time to renegotiate with advertisers for better rates.

How does the blog receive traffic?

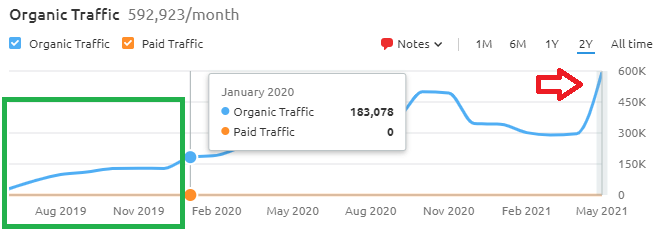

Do most of the blog’s monthly readers come from social media, paid ads, search engines, a newsletter, or backlinks from other blogs? Again, this is where you want to consider risk. If most of your traffic comes from a single source, how secure is that source?

Consider the example where most of your traffic comes from a single high-traffic blog post on another website. What happens if that blog post becomes less popular or even gets deleted?

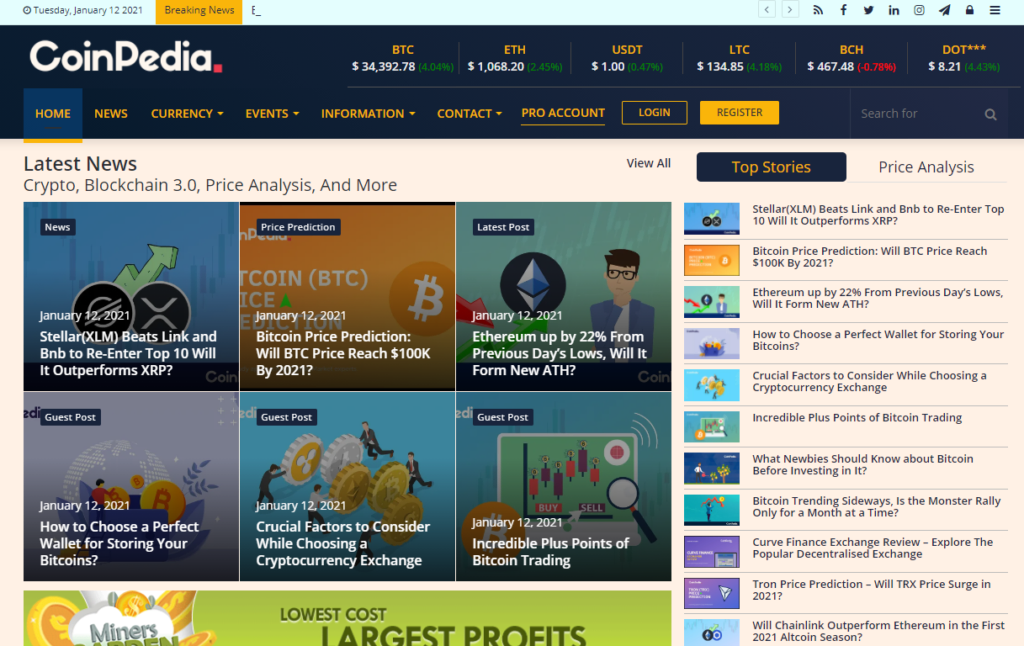

Media and subscriptions

The media industry has historically been a target for private equity on a broad scale. Private equity firms or billionaires own most newspapers and media outlets globally. These days, many of them have been bought rather than built.

Private equity firms love subscription businesses and anything with a steady cash flow. Everyone thinks it’s a great idea, but consistently creating content is hard work. So there’s a mass graveyard of news and digital magazines with excellent backlinks and content but no longer an audience.

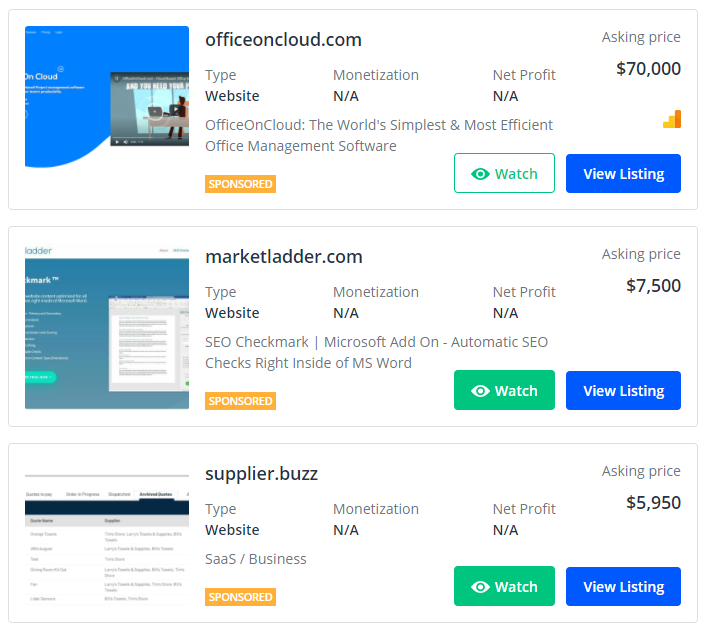

Buying SaaS Websites

A SaaS can be more involved than content-forward websites that a single person can run independently. They often require technical expertise, a sales team, and the ability to hire skilled employees or freelancers.

Also, SaaS companies have higher buying prices, lower margins, and require higher monthly expenses. Buying a SaaS company means solving customer problems using the software.

Factors to consider while buying SaaS companies are:

- Knowing the industry – You need to know the industry and the customers’ pain points. Otherwise, you will spend time designing functionality your customers are not interested in.

- Consider Essential Metrics – You should analyze P&L statements, operational costs, annual revenue, and profit margins. You can also ask for marketing metrics like LTV, CAC, and ROAS.

- The Pricing Model—Understand the pricing model and find ways to improve it. SaaS business models offer many pricing plans, including multiple-tiered options based on customers’ needs, flat pricing, etc. The number of existing customers and customer acquisition rates can also influence this decision.

- Source Code—Access to the source code is another essential consideration in a SaaS business. When I purchased my first SaaS program, the programmer never delivered the source code, so I had to stay with that buggy version for almost a year until I could get a team and recode it from scratch.

- Customer Acquisition Channels – Find out the percentage of acquisitions made by each channel. A business that relies on organic, direct, and social media will likely improve its bottom lines. However, a company that relies overtly on paid advertising is unlikely to be sustainable in the long term.

- Look At The Scalability – Can you improve customer satisfaction, enter new markets, and offer new services? Would that allow a slight increase in the pricing?

eCommerce websites

Statistics suggest that by 2040, 95% of all purchases will be via e-commerce stores. Moreover, the e-commerce industry is growing at 23% Year over Year. Buying or selling an e-commerce website can usually be pretty lucrative.

I believe eCommerce websites are among the most lucrative websites you can purchase but require the most attention. You should analyze the figures, profit margin, and traffic sources well, or you may end up with a nonprofitable store and inventory.

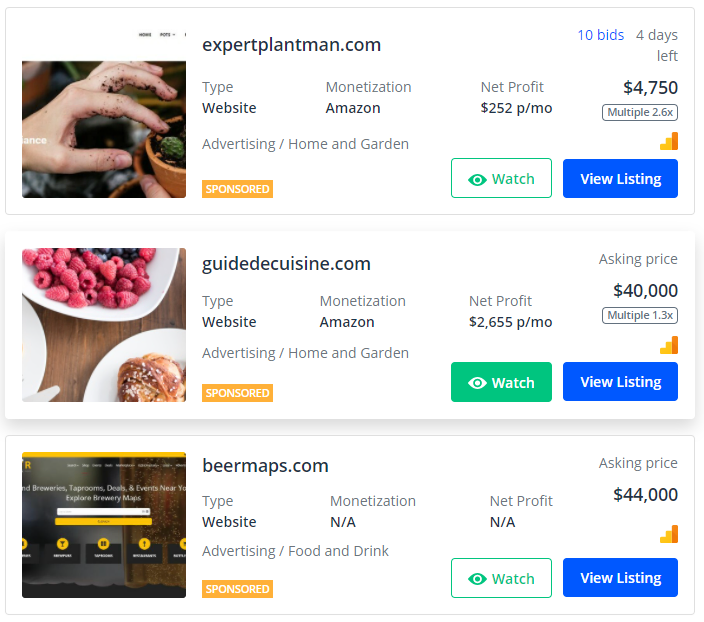

Affiliate Review Blogs

Unlike personal or business blogs, affiliate review blogs are designed from scratch to make money via affiliate marketing programs like Amazon Associates or others. They are designed around a niche, like kitchen appliances, and review products people search for.

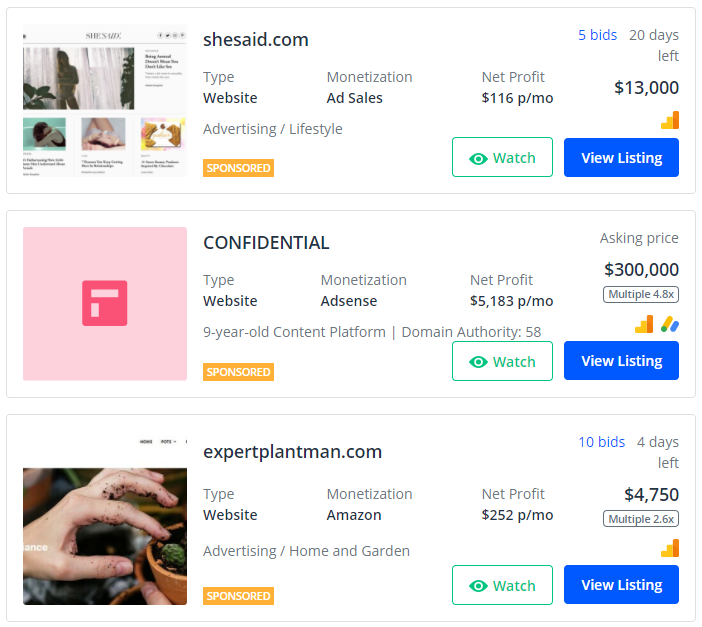

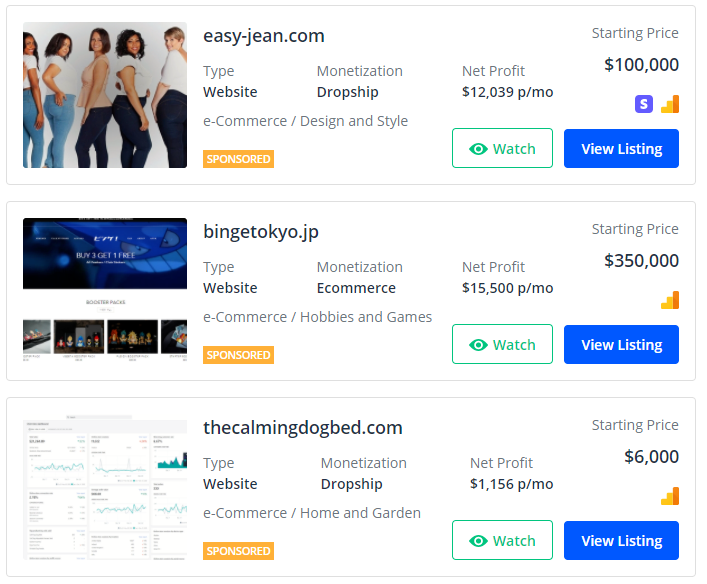

Below are several examples of affiliate review blogs that are available for sale. As you will see, the niches are diverse, and I recommend purchasing only one if you have expertise in that particular niche.

There are affiliate marketing blogs that make more than one million in profits year after year. Replicating their success will not be easy, but you can come close with persistence and scaling your work.

Check our guide on starting and managing affiliate marketing blogs that make $100K/year.

It’s time for a short recap. Until now, you know the advantages of online businesses and what type of online businesses you can purchase.

Let’s talk next about where you can buy websites.

Where can I purchase websites?

There are a few different routes that you can take to buy your future website:

Auction Sites for Smaller Websites

These services host auctions for sites and businesses and typically work well for small transactions (less than $100,000). They are quick to list on and expose the sale to many buyers.

Yes, it’s fun to scroll through endless businesses, but you typically have to act quickly and expect competition if you want to buy. These websites can attract a lot of traffic, and good deals don’t last long before someone grabs them.

Here’s just a handful of auction sites to buy businesses:

- Motion Invest – All the websites listed on their marketplace are verified and vetted by their team. Most are Amazon affiliate websites with a monthly revenue ranging from $30 to $5000.

- Flippa: If you don’t mind vetting businesses alone, Flippa is a trendy business marketplace. You can browse thousands of online businesses, with purchase opportunities starting at hundreds of dollars.

- Exchange Marketplace: Owned by Shopify, this eCommerce marketplace exclusively buys and sells Shopify businesses. The significant benefit here is that Shopify uses its internal data about each store to verify numbers before you make a purchase.

- Digital Point Forum—This auction forum has many newly launched websites for sale. You should visit if you are looking for new projects at low prices.

- eBay – There is an auction section for websites on eBay where you can find goodies to purchase. Like on DigitalPoint, many of the listings are projects that just started.

Business Brokerage Companies

Business brokers are agents who help shoppers find a site. These companies perform due diligence, evaluate the business, and negotiate the sale. Of course, they also take a cut of the sale!

Here are several website brokers I recommend:

- Empire Flippers: This online brokerage firm vets every business to ensure that scams or poorly run businesses aren’t on the website. According to Greg Elfrink, Director of Marketing at Empire Flippers, the team turns down about 92% of the companies that try to list on their website.

- MicroAcquire: Like Empire Flippers, MicroAcquire is respected for its vetting process. It specializes in startups. The acquisition process starts blind, with the prospective buyer and seller exchanging minimal information to determine interest.

- FE International—Their clients are usually high-end companies, covering transactions that start from five figures and go up. They ensure that each sale through them is legit and guarantee a scam-free environment.

- Motion Invest – This website brokerage focuses on buying and selling money-making blogs monetized through affiliate marketing.

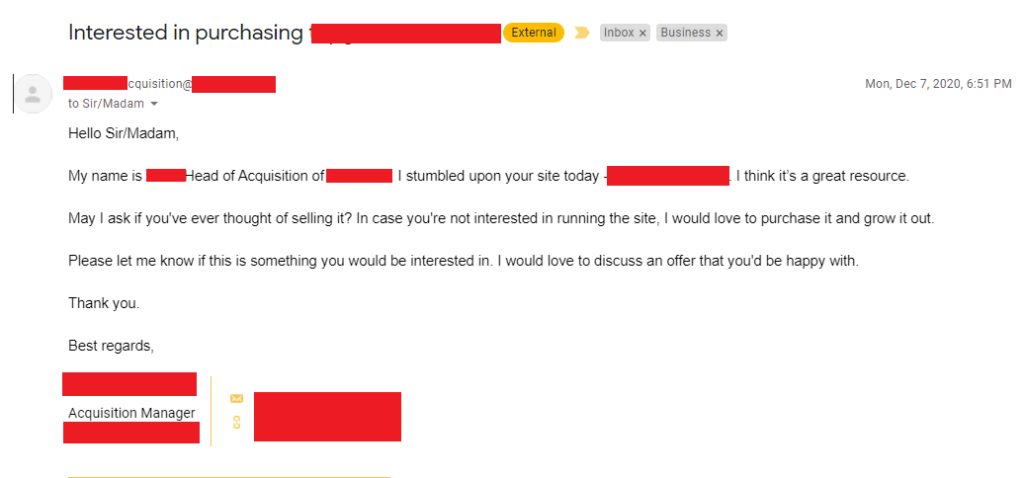

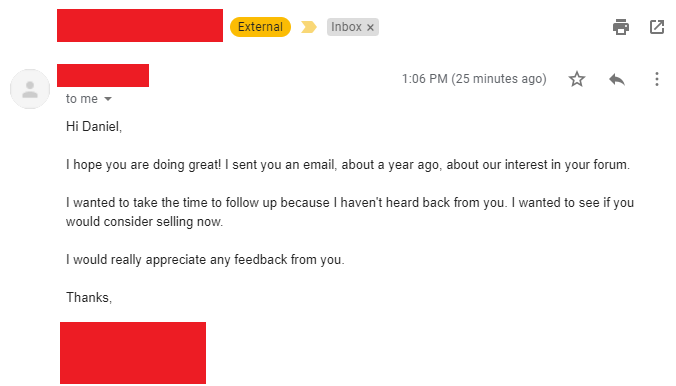

Cold email founders for off-market deals

The best deals happen where there’s no competition. However, finding off-market deals requires a lot of creativity and drive. They’re called off-market deals for a reason. You’re reaching out to people who may have no interest in selling.

This might be done through strategic emails sent out to companies you think might be interested in selling the websites. Look especially for companies you’ve dealt with before (advertisers, partners, etc.).

The rejection rate can be enormous, and you should get used to hearing “no thanks.” But remember: you’re playing a numbers game. Send enough inquiries, and someone will eventually be interested.

Now that you know where you can purchase businesses, find out how to evaluate them to distinguish great opportunities from online businesses that are not right for you.

What financing options do you have?

Most buyers looking to purchase an online business have all the funds ready.

However, if your funds are tied up in your current company or other business endeavors, there are several things you can consider:

Look for potential investors

If you have a part of the funds, you can seek potential investors to cover the rest for company shares and/or profits. This lowers your initial costs but multiplies your time and headaches trying to work with a partner. It also means you’ll have to split any profits from the business.

So, if you want to go on this path, check your business contacts and ask them if they are interested.

Get a Small Business Administration Loan

The SBA is a federal agency that helps small businesses get loans. It doesn’t issue loans itself but instead works with lenders to overcome obstacles to business lending, such as guaranteeing loans, reducing risk, and sourcing capital.

Whether you’ve been declined credit before or have a poor credit history doesn’t matter. You might still qualify for a loan with the SBA. That said, they do have specific eligibility requirements, including:

- The business must trade in the US.

- You must have invested in the business yourself.

- It must be a for-profit business.

- You must have tried but could not source funding from traditional lenders.

You can borrow up to $5 million, more than enough to acquire small or even medium-sized businesses. However, you can only borrow what you can afford to repay, which an SBA-approved lender will determine when you apply.

As a federal agency, the SBA enforces responsible lending and risk management so lenders can afford to charge lower rates and fees.

Get a Home Equity Line of Credit

If you have more than 20% equity in your home, you may qualify for a home equity line of credit (HELOC). A home equity line of credit (HELOC) taps into your home equity value and functions similarly to a credit card. Still, the interest rates are often significantly lower.

You have access to HELOC funds on a revolving basis for a defined period, after which you must pay it back with interest at a variable rather than a fixed rate.

Before you borrow, you need to know when and how much your interest rate might change. Can you afford the monthly payments if they go up later? How much of an increase can you stomach?

Remember that your home’s equity is used as collateral for the loan, meaning that you could lose your home in foreclosure if you cannot pay it back.

Make an offer and do price negotiations

After reviewing the business selling prospectus, following up with Q&A, and conducting your due diligence, you should be ready to make an offer for the business.

The most important things to factor into a competitive letter of intent are:

- Consideration—Make the offer structure explicit. What is the split between upfront consideration vs. holdback and seller financing? What are the conditions attached (if any)?

- Owner financing – financing is typically offered on a case-by-case business. The majority of smaller transactions are all-cash.

- Non-compete: Most sellers will typically commit to a 2-3 year non-compete agreement, but ensure you ask for this in any event.

- Speed and certainty –Often, the best offer is not the highest but with the most significant degree of speed and execution certainty. Buyers that can proceed through due diligence, legal workstreams, and into closing the fastest will be more likely to have their offer accepted from the outset.

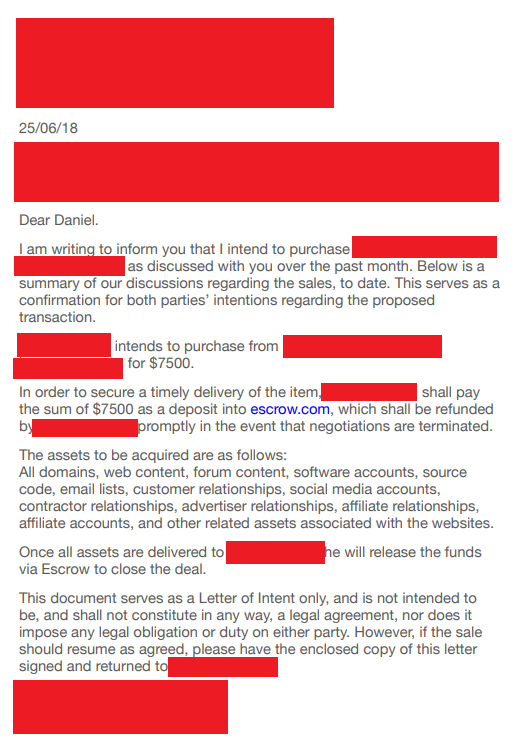

Below, you can see an example of a letter of intent (LOI) we received:

Complete the purchase

I recommend using an escrow process to facilitate the secure funding of the transaction and transfer of assets. The go-to solution below $500K is usually Escrow.com. Be highly cautious about transferring funds outside of an escrow service.

Assets Transfer and Inspection

The transfer of assets usually involves (but is not limited to) the handing over of:

- The domain name(s)

- Website content

- Branding assets.

- Social media accounts.

- Client database (email lists)

- Source code repository

- Advertising and affiliate accounts (if applicable)

- Physical inventory (if applicable)

- Services accounts (e.g., OptinMonster, HelpScout, etc.)

In the sporadic case that assets have been misrepresented or not transferred in their entirety, the buyer can notify the escrow agent during the inspection period. Escrow.com staff will reverse the transaction if there is a legitimate misrepresentation.

However, the escrow inspection period is not a “try before you buy”. Once all of the assets listed in the APA are transferred, accounted for, and operational, the buyer is expected to release funds immediately.

Support from the seller

After the transaction has closed, there is typically a 1-3 month period of training and support during which the seller helps the buyer learn the business’s day-to-day operations. In transactions with contingent consideration or seller financing, the seller will occasionally maintain a high level of involvement to meet mutually agreed-upon performance or training goals.

Make sure that the level of post-sale support is agreed upon beforehand.

What are the next steps after buying a website?

Now that you ultimately control the online business and the transition went smoothly, you should start growing it. I’ve seen many sellers rush to make as much of their investment back as possible and not further invest in the business.

They do this by adding more advertising or running extensive discount campaigns. In the long run, this will devaluate the business, and I don’t recommend doing it.

First, you purchased the business because you wanted to grow an asset, not because you wished to earn money fast, no?

Buying an online business FAQ

How to buy a website?

How much does it cost to buy a website?

Is buying an online business a good idea?

- Skip the first year or two of cashless hustle 👌

- Gives freedom 👌

- Offers incredible scalability 👌

- Provides access to a worldwide market 👌

- You are building an income-producing asset 👌

Tips from people who purchased websites

Emilia Gardner bought websites from Empire Flippers and Flippa in 2019. In the video below, she gives her unbiased opinion about buying passive income websites through both companies. She offers a few points to consider as you move through the website buying or selling process.

Ahrefs has a step-by-step video tutorial for finding and identifying undervalued websites.

Zach Zorn from MoneyNomad shares in a video review what he learned from spending $49,000 buying an affiliate website:

Conclusion

Buying an established website or an online business can be a great way to invest in a successful venture and start making money immediately. You could repay the money you invested in the purchase reasonably quickly and then enjoy steady monthly profits.

We hope we’ve illuminated the issue of buying a website or an online business.

Purchasing a website for five or six figures isn’t something you can do overnight. It requires an investment of both time and money.

You can hire us if you need help getting a professional website or online business evaluation.

Are you on the other side of the fence and want to sell a website? Check out our tutorial for website sellers.

Monetize.info We Help You Monetize Better Your Digital Assets! 💰👍

Monetize.info We Help You Monetize Better Your Digital Assets! 💰👍